From The 2 Time Champions in

This 30 Minutes will Transform The Next 30 Years Of Your Life...

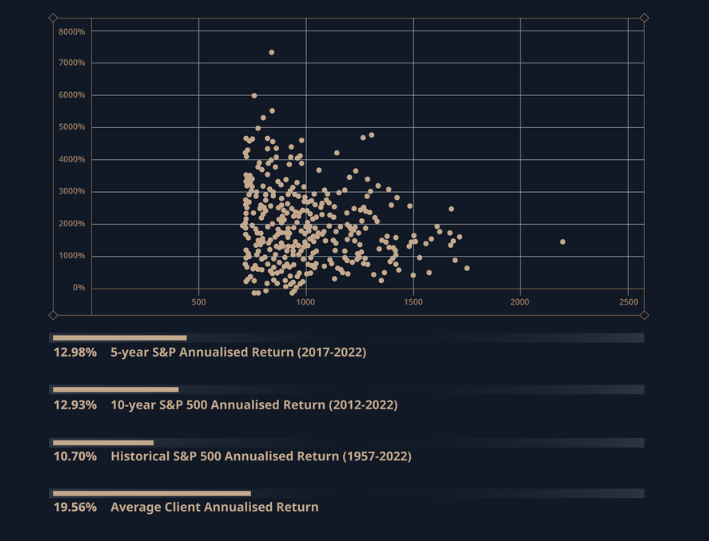

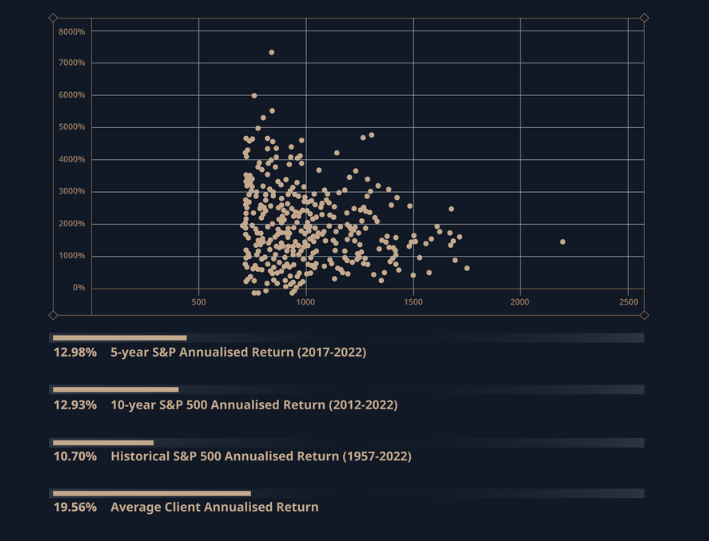

Over 19% Returns Per Annum For 700 Clients and 7/10 Homes Sold At Record Prices

Featured on:

Average of 19.84% returns Per Year for Investors and Home Buyers

Average of 7/10 Homes Sold At Record Prices

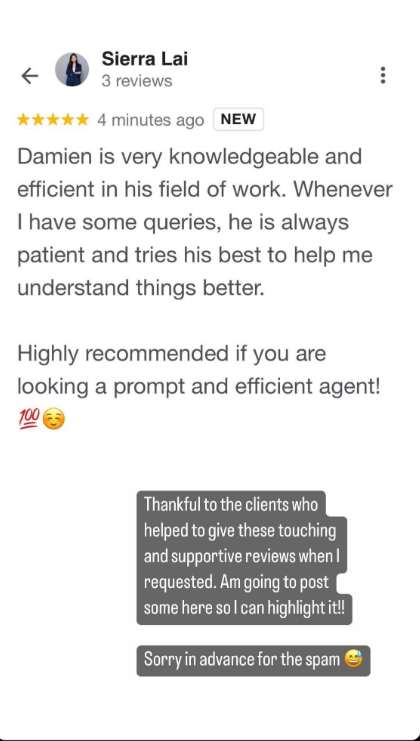

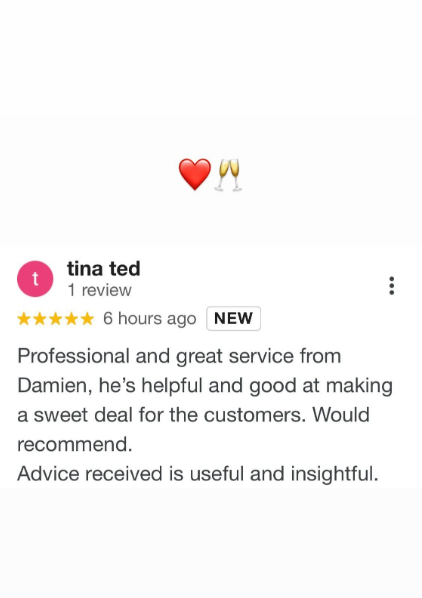

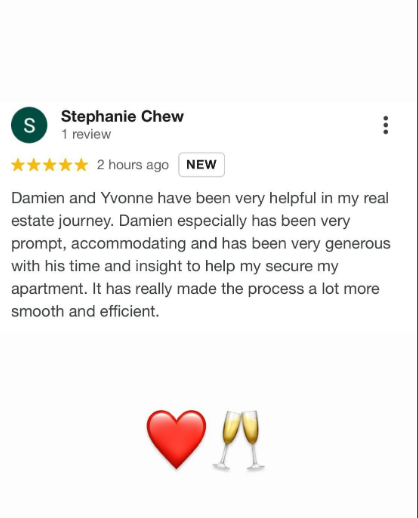

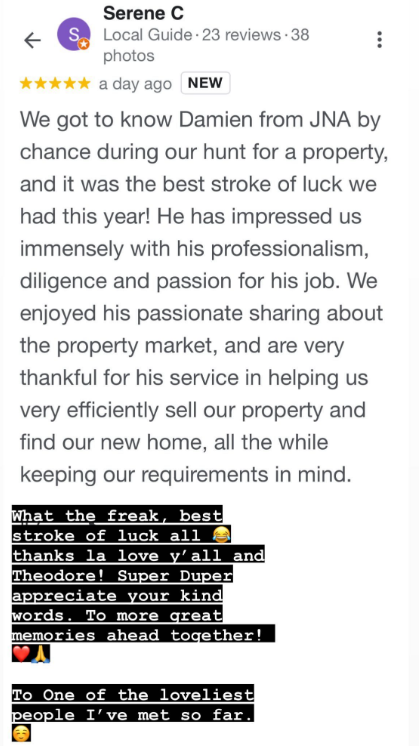

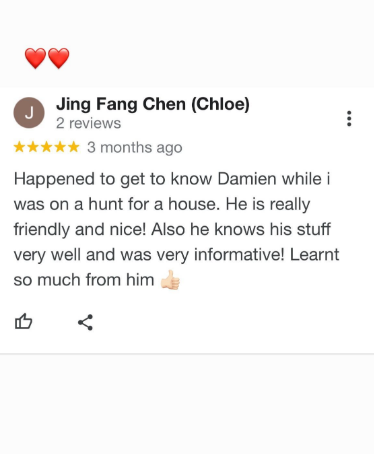

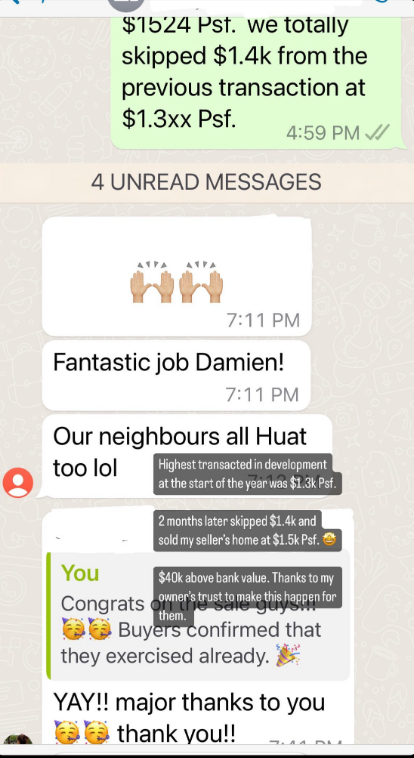

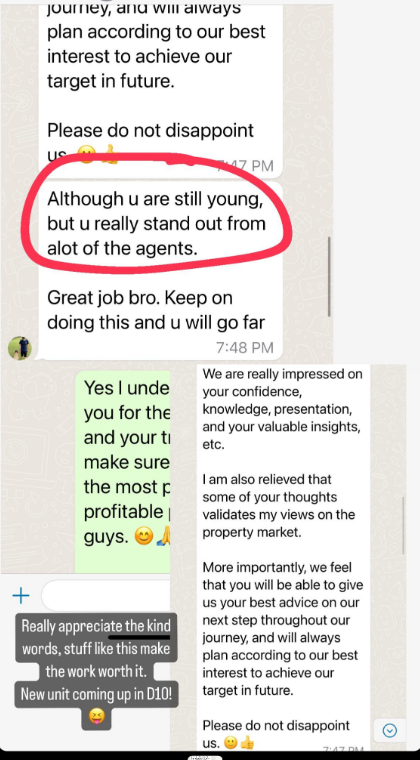

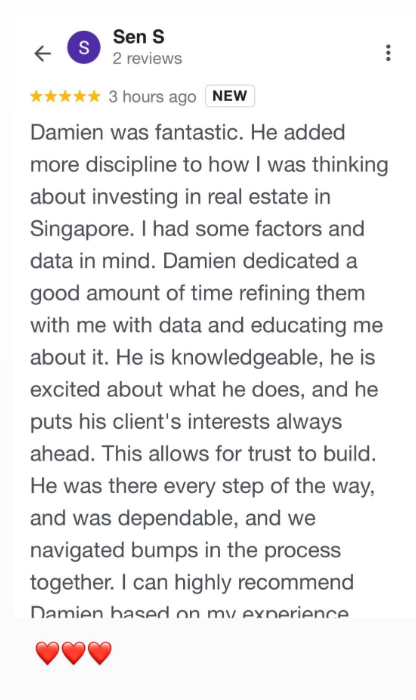

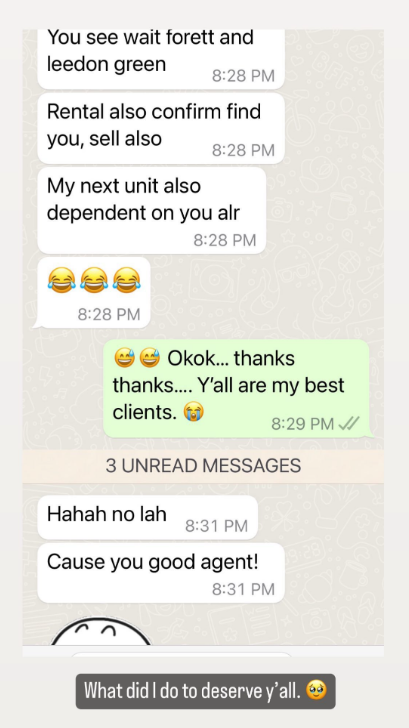

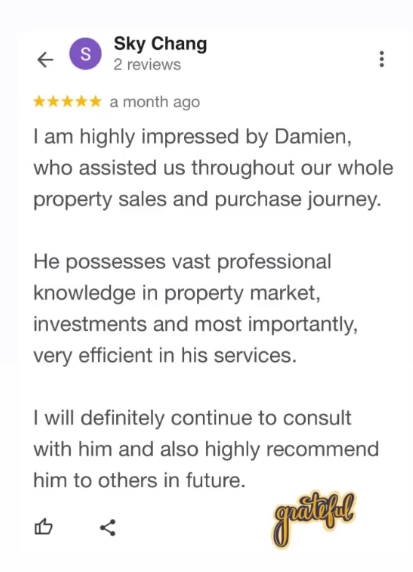

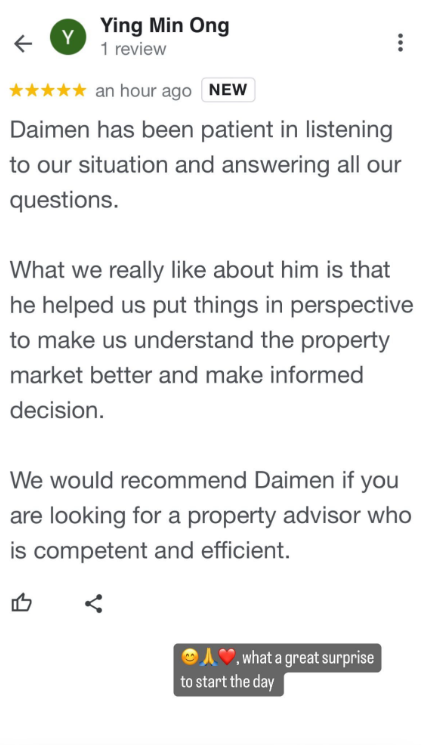

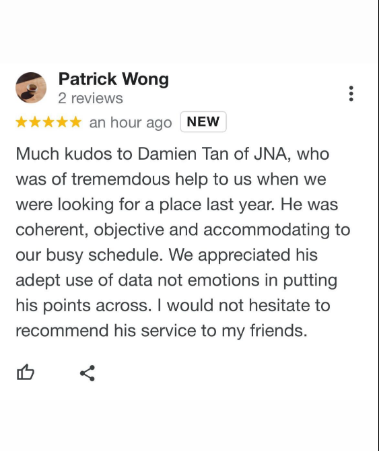

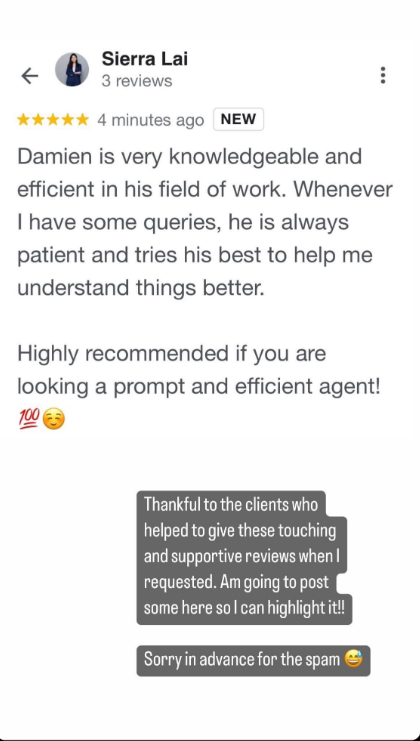

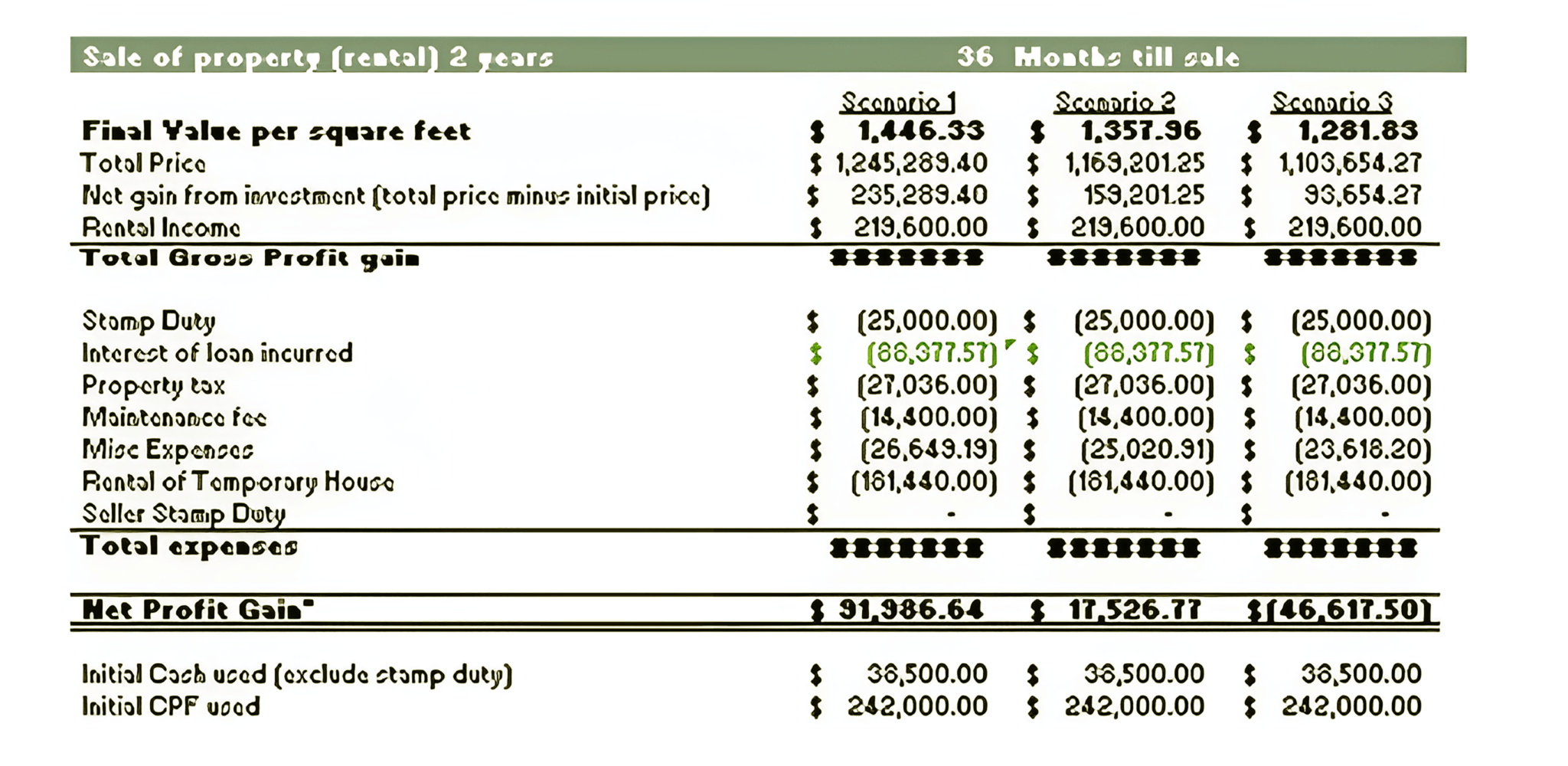

Past Client Testimonials

Lives Transformed Using Our Strategies!

Served ~700 Investment Clients & Sold More Than 3000 Homes, With 7/10 at Record Prices

Past Client Reviews

For there to be a

correction or crash

For there to be a correction or crash

In today’s Market, where Prices are much higher compared to 3 years ago, entering is not as easy nor as safe as the past. However, does that mean that we should wait for prices to come down and enter then? All that we know is no one knows what will happen next! But what we know is in the long run, the market goes up much more times than it comes down.. For there to be a correction or crash, there must first be a Bubble that’s right! But question, is there a bubble in Singapore? Here is some stuff for you.

- Out of 100 homes, about 95 are occupied

- Average household incomes are about $11-13k Which equates to a $2m property affordability in terms of loan.

- Average Newly MOP HDBs are transacting at $700-800k which after cashing out about 500k, is enough to fund a S2m property

- Global Bubble Index went down consecutively over the past 3 years during the surge in prices

- Population increased 290k in 2023 to 5.9m and is on the rise to 6.5m by 2030.

- Average Household net worth went up by 8% in QI of 2024 as well as average income increment of around 5% per year in 2022 and 2023,

- During March 2020 when the prices of Real Estate in the world’s major cities went down by about 20-40%, Singapore went down by 1% and not fire sale of homes to be seen due to strong savings rate and holding power.

Our Investment Mandate

Multi-Layered Investment strategy

Macro Economics Forecasting

Understanding Fundamentals of

Singapore Real Estate

– Fundamental Analysis

– Technical Analysis

Micro Factor Analysis

Quantitive Analysis

Qualitative Analysis

Investment Strategy

Based on life stages

Offesive vs Defensive

PlayConcept Planning

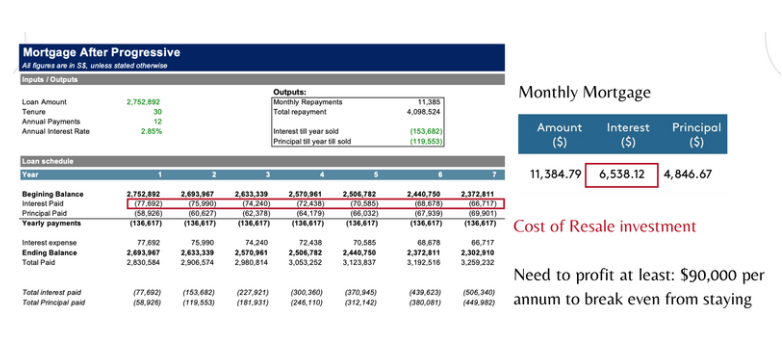

Financial Modelling

Cashflow Projection

(safe leverage)

Quantitative Valuation Metrics

Calibration of Return on Equity

Shifting Investment Thesis during different life cycle

1. Detailed Portfolio Analysis

First meeting to understand your needs and what your goals are

Based on your current portfolio, to customize the best strategy for you

2. Customised Investment Solutions

- Tailoring investment strategies to meet individual client goals and risk profiles.

- Personalized portfolio management services.

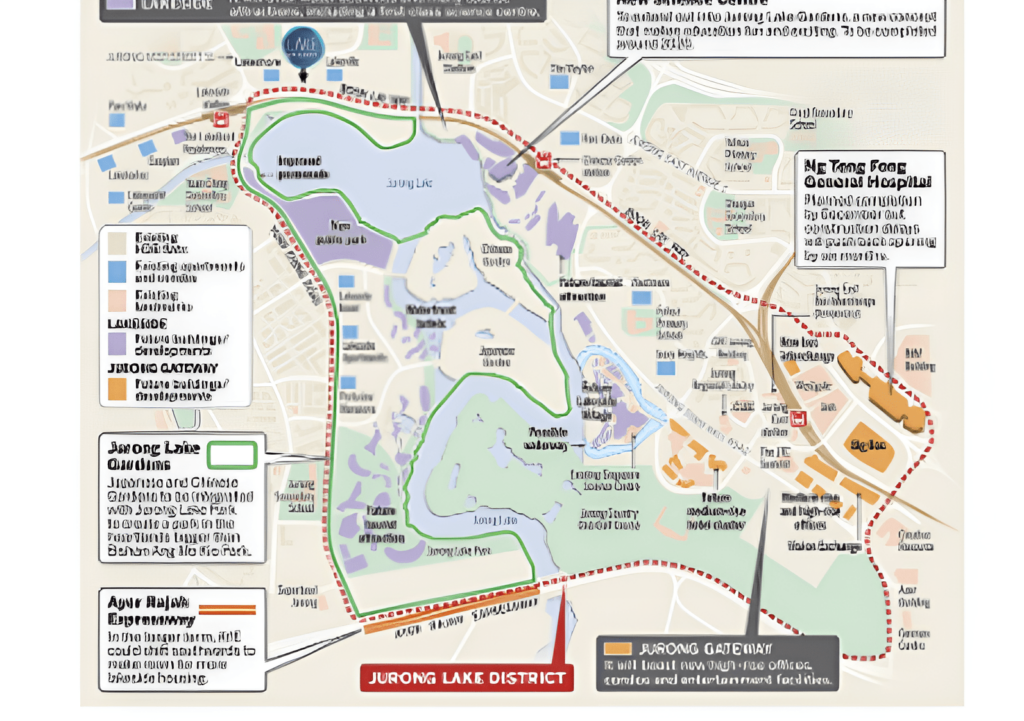

3. Macro Trend Analysis

- In-depth analysis of current Singapore market trends and forecasts.

- Supply and Demand in the Market.

- Interest Rates influence on the Market.

4. Understanding Our Team's Investment Philosophy

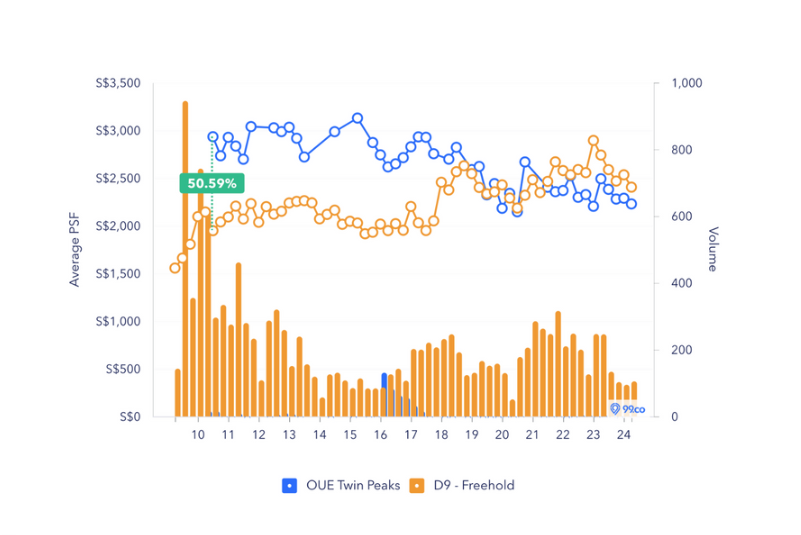

- Our 5-step factors to choosing your winning property

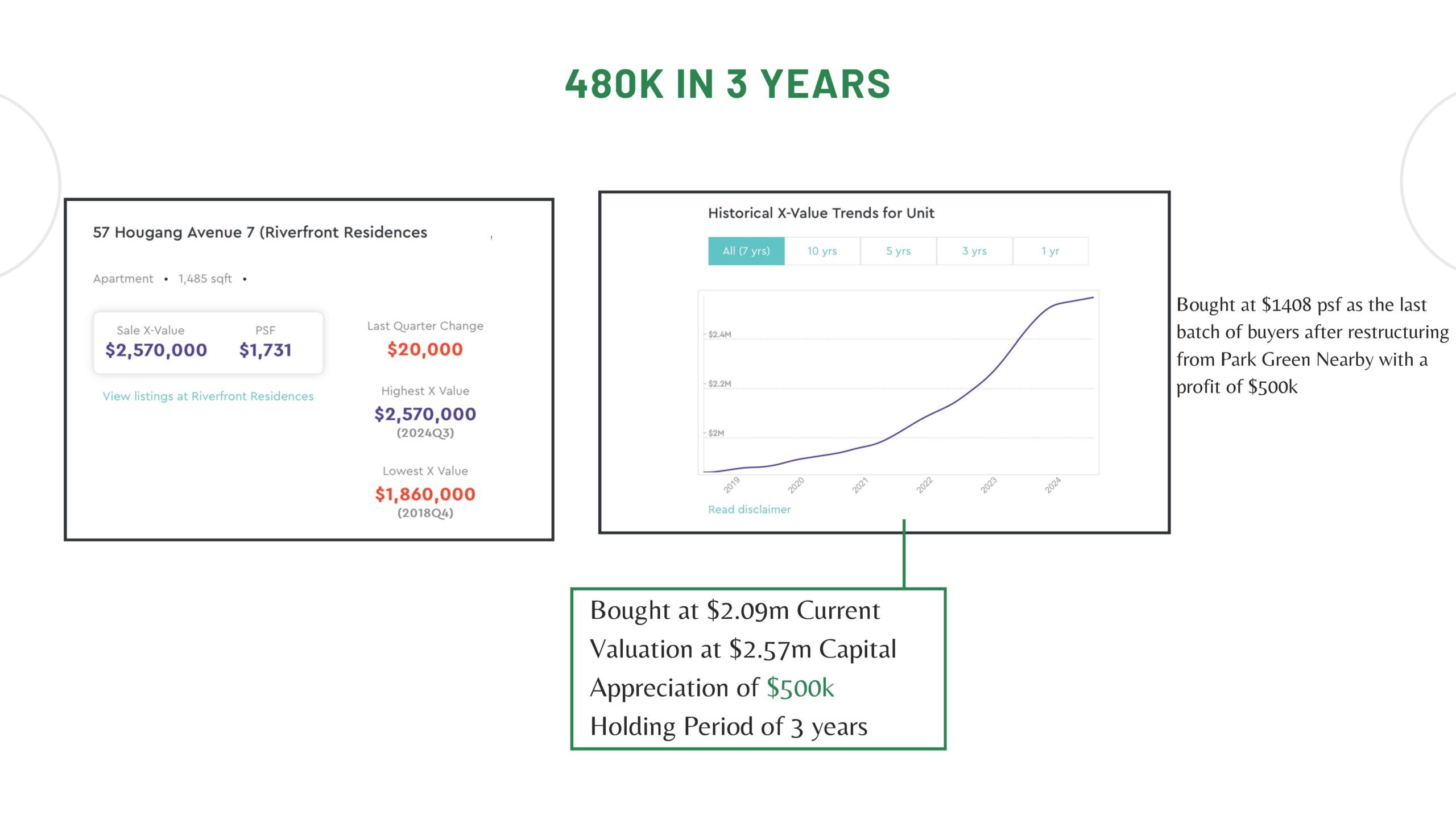

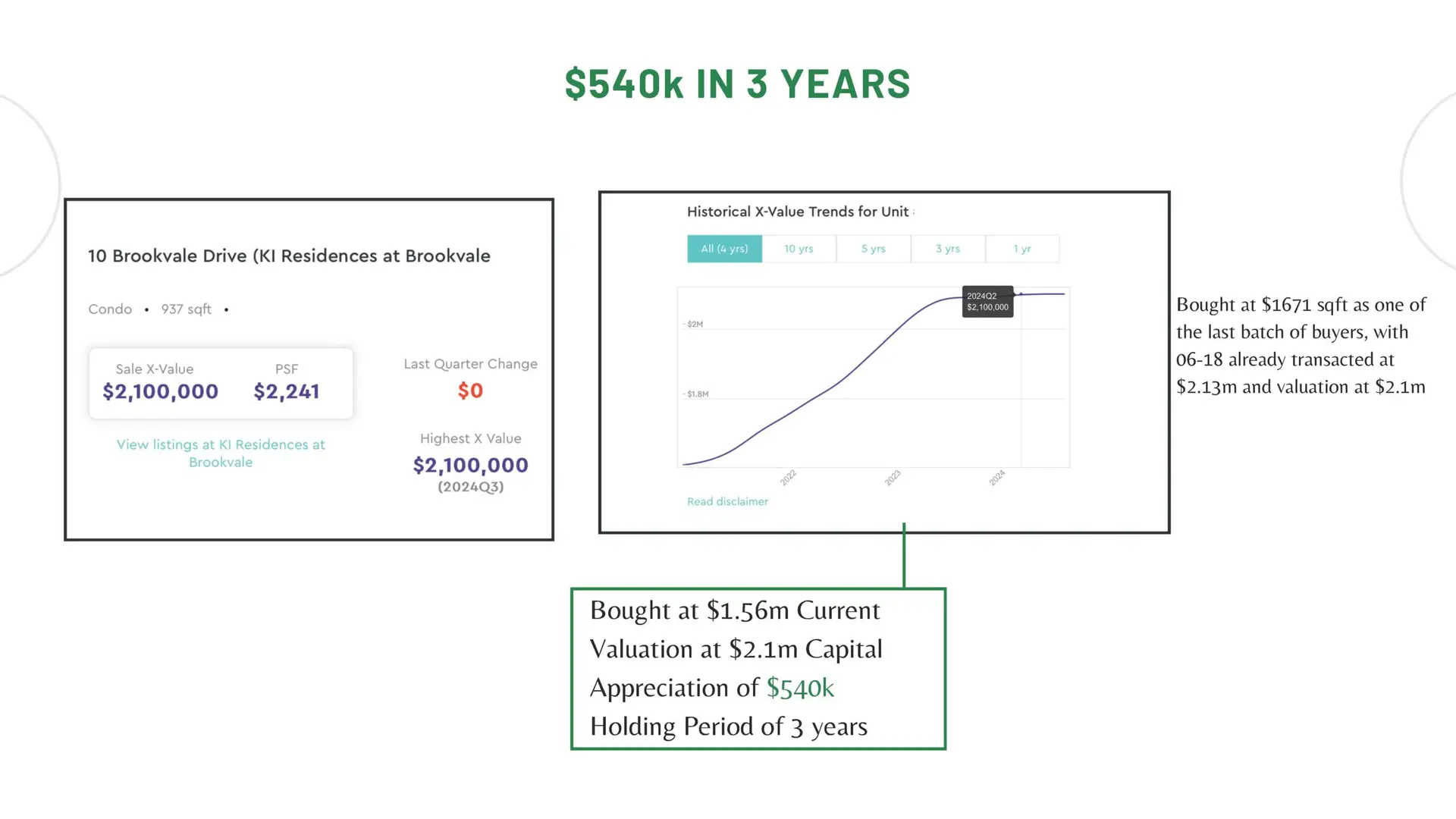

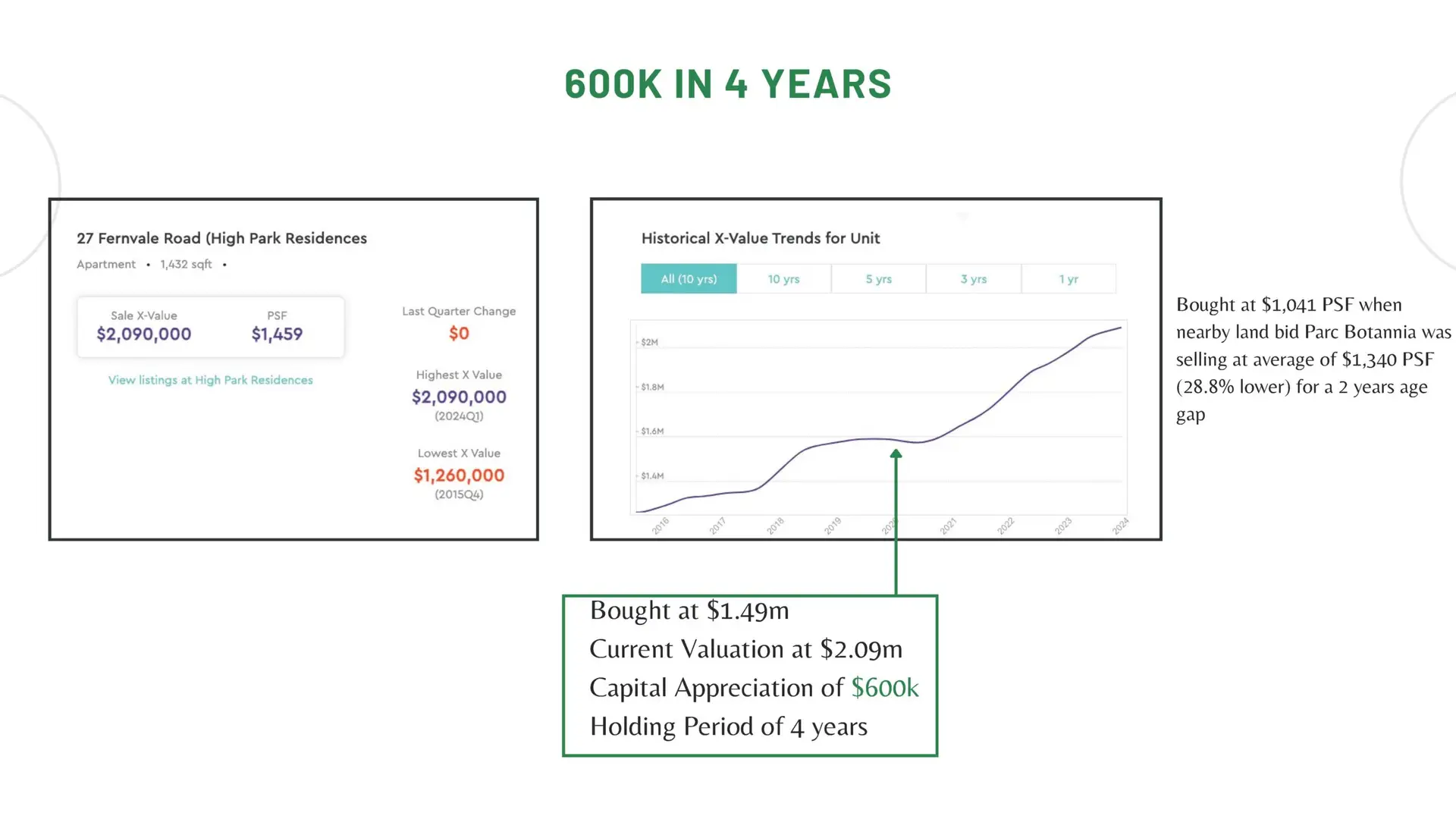

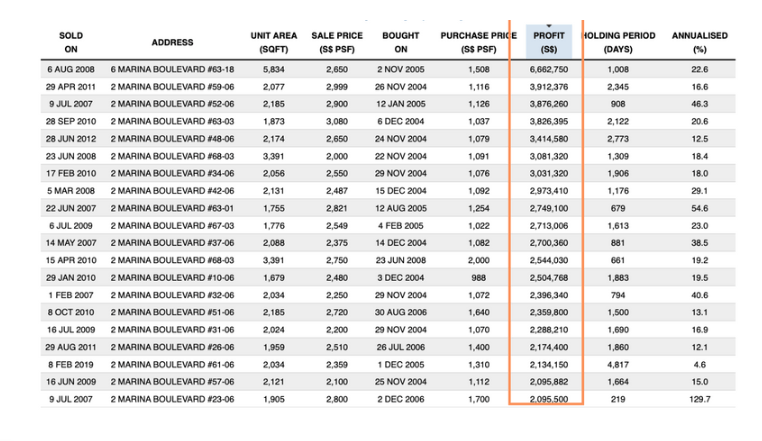

- How have we consistently helped our clients profit 6 figures in the both the resale and

BUC market

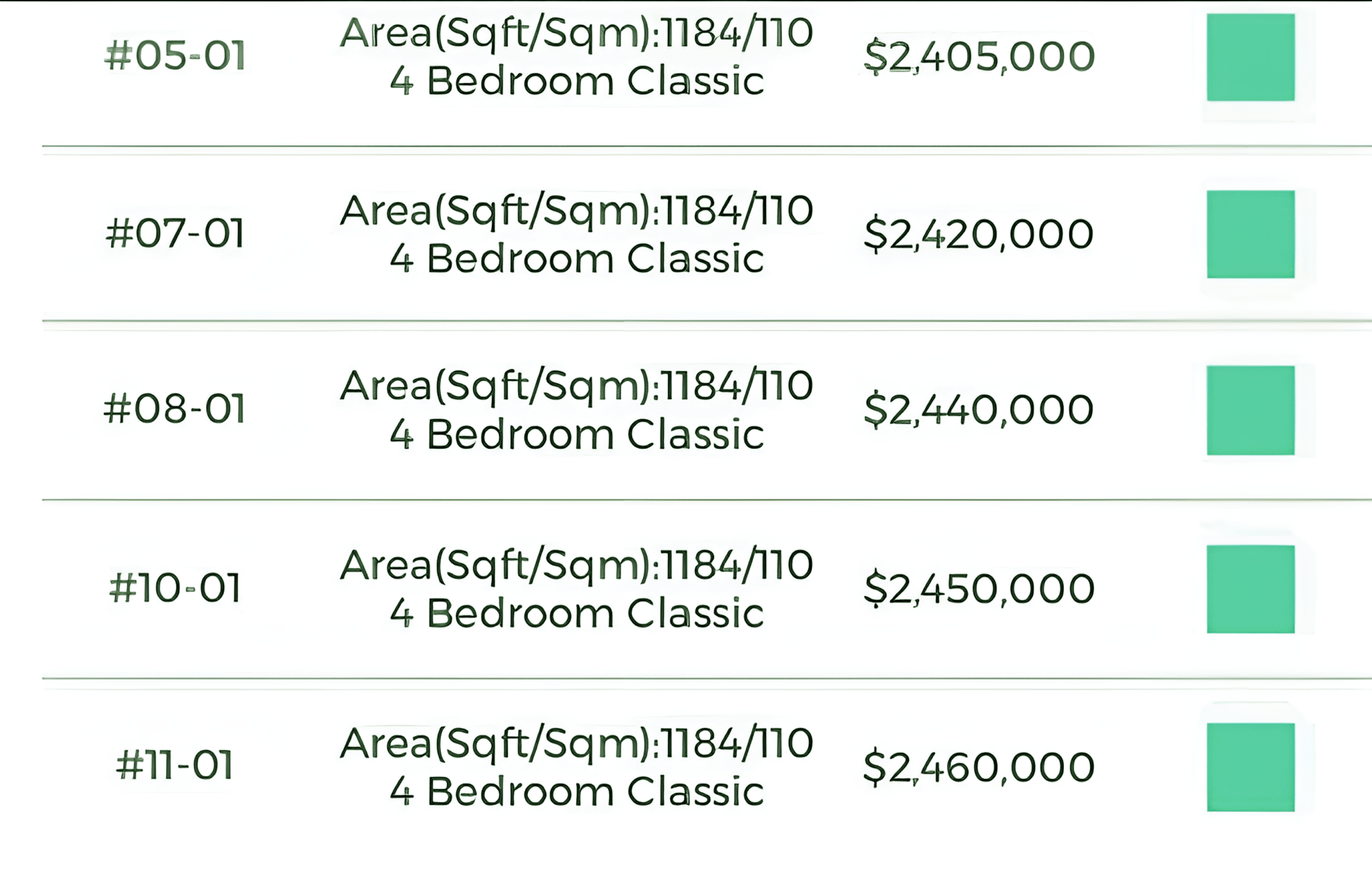

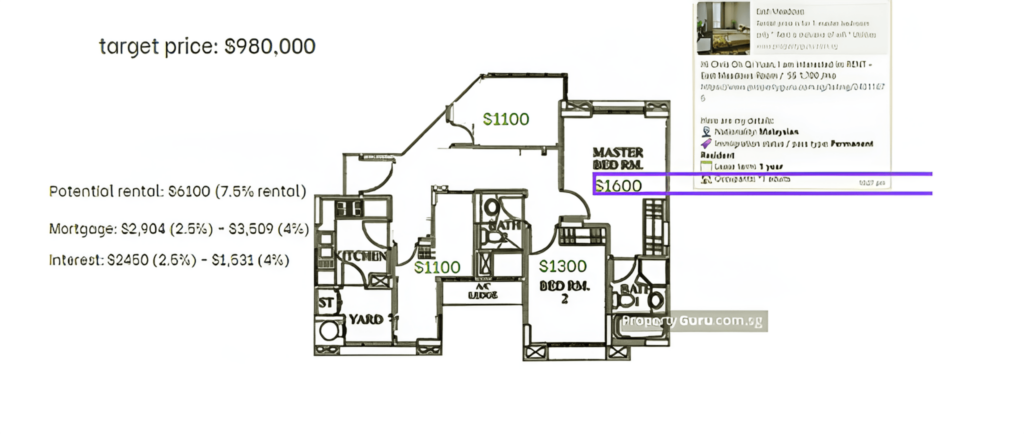

5. Buyer's Proposal

Stack Analysis

Correct Entry Price

Unit Selection

Comparison with Surrounding Developments

Floorplan Analysis

Future Transformation

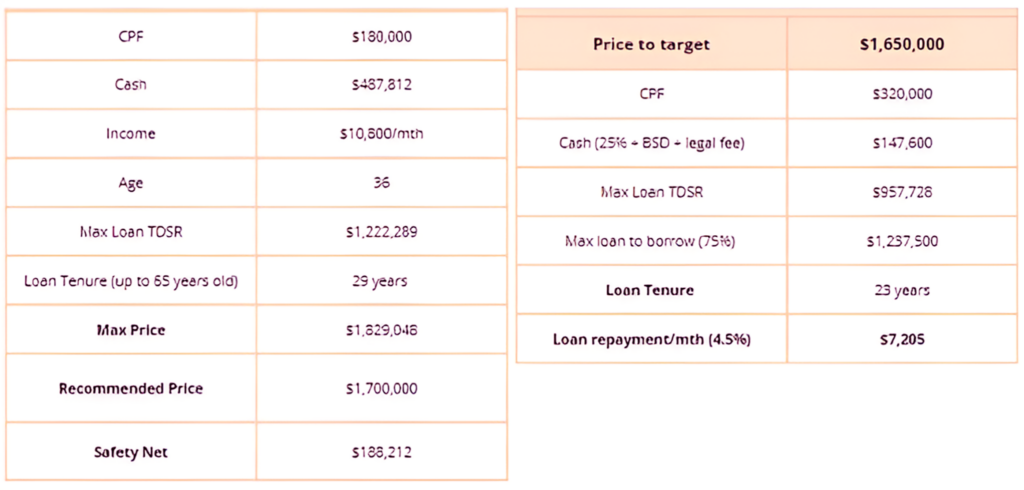

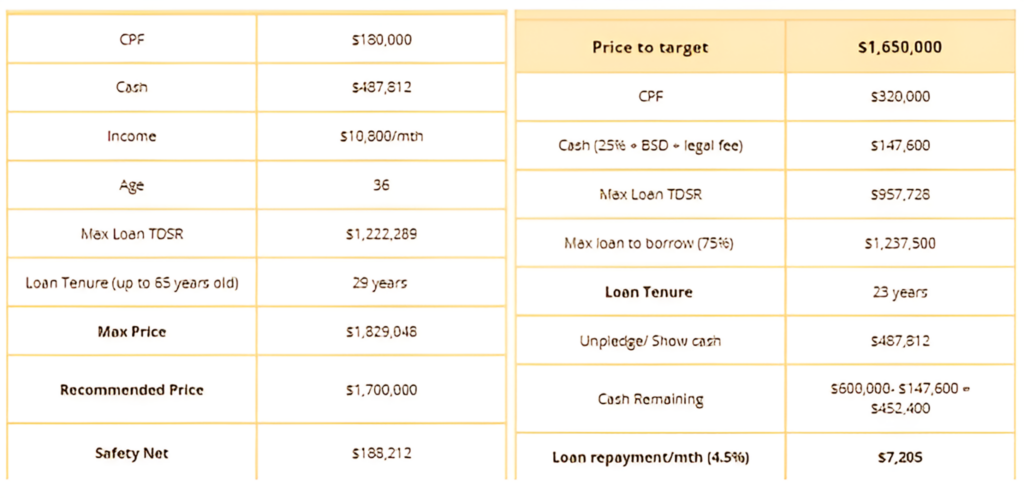

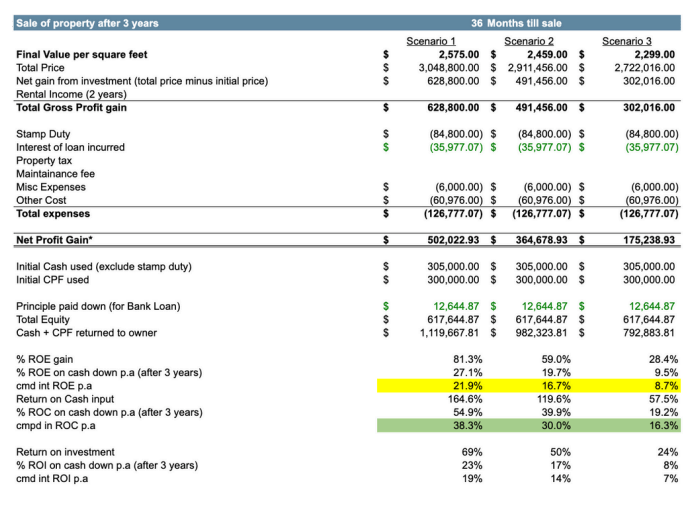

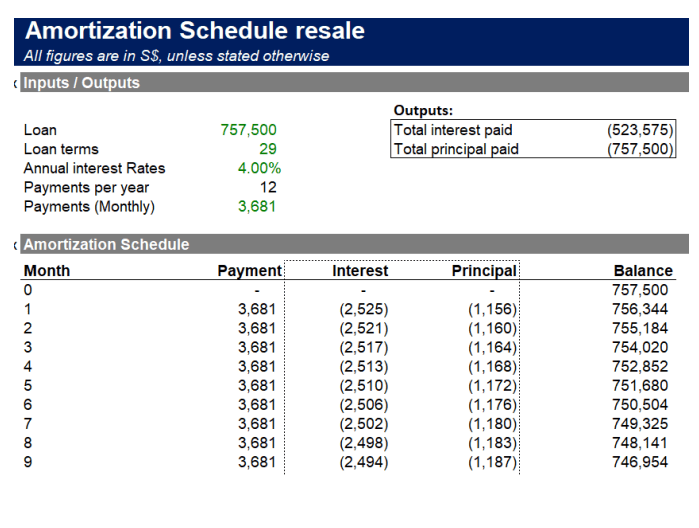

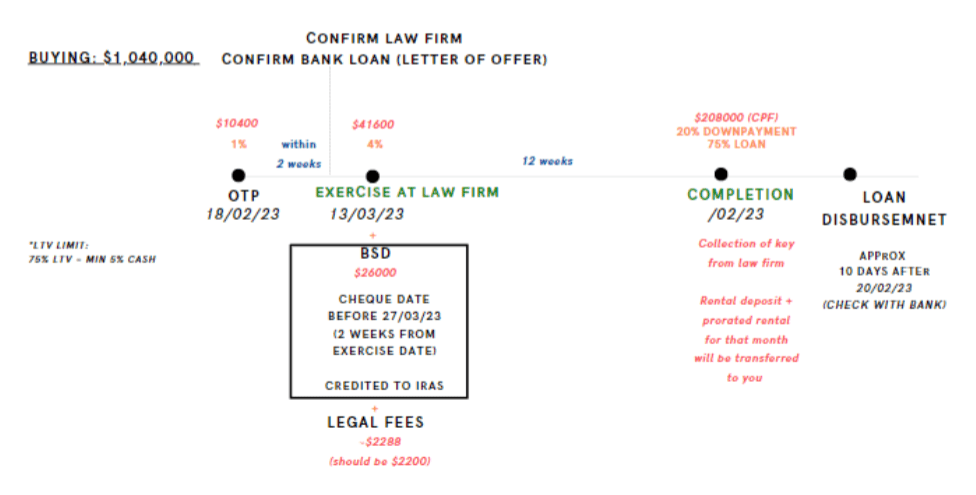

6. In-Depth Financial Analysis & Projections

The only thing that worries me today is not prices coming down but the artificial suppression of affordability in the form of Cooling Measures. We can see that Singapore outperforms the market during uncertain times.

That is why its not about whether to buy or not, but instead, what to buy to make sure that we fulfil the criteria of “never losing money” in our investments as well as the Assured Capital Gains that our clients have been able to enjoy.

7. Partners for Best Bank & Conveyancing Rates

Competitive Bank Rates & Conveyancing Rates

One Stop Solution for Legal/ Financing Services

8. Timeline Planning, Paperwork, Coordination

9. Post Completion

Rental team to take over the unit

Sell-side team to take over sales to ensure highest profits and operational excellence

Ensuring that tenants are found in a timely manner after completion

10. After Service Client Care

Bi-Annual Gala Dinner for our clients

Exclusive invites to our investment seminars

Scheduled updates on portfolio performance

Updates on Market Trends and Opportunities

Get Your free consultation Today!

Join our community and foster relationships together with all out clients and investors and get exclusive invites to our activities like quarterly investment summits as well as Gala events!

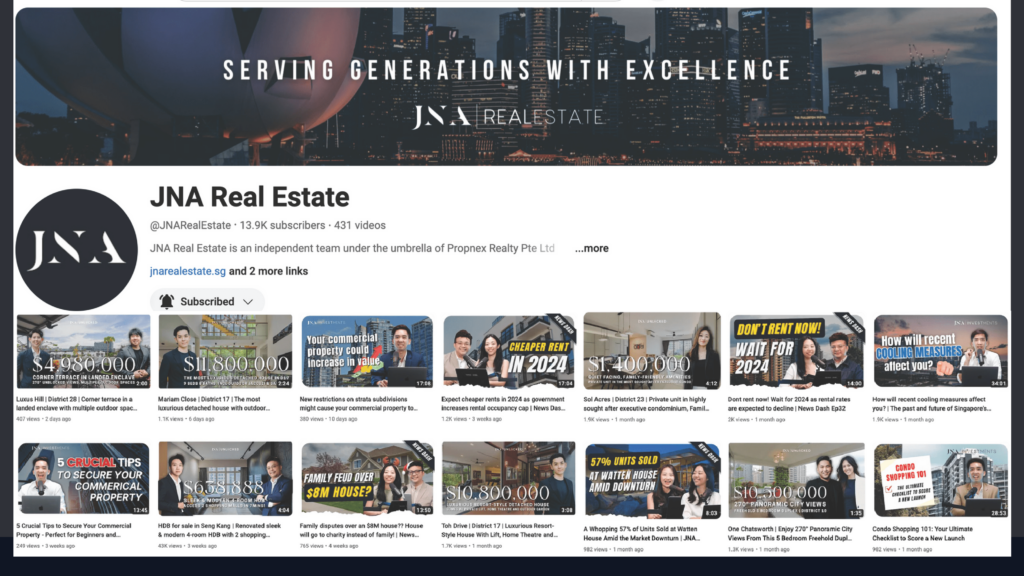

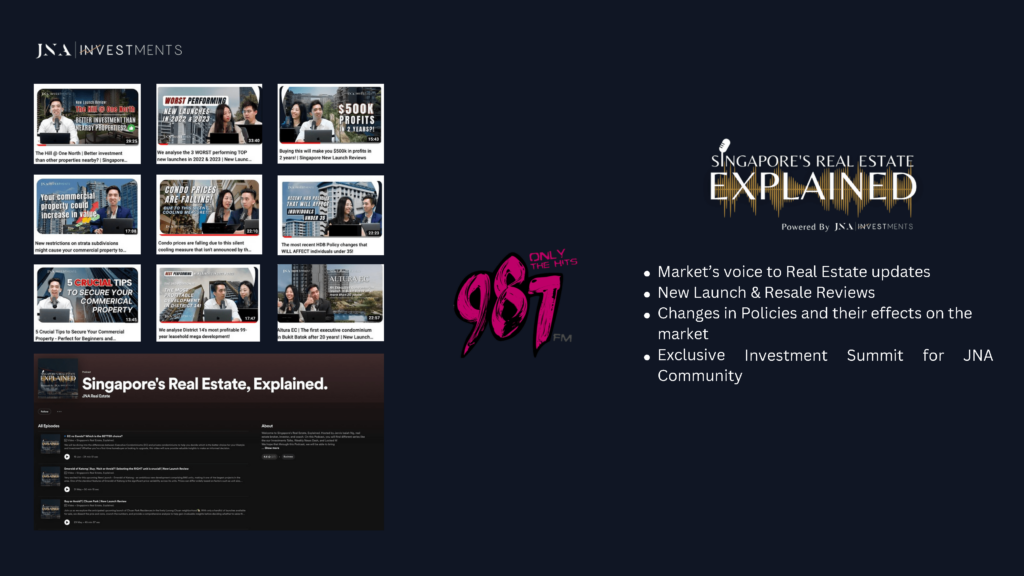

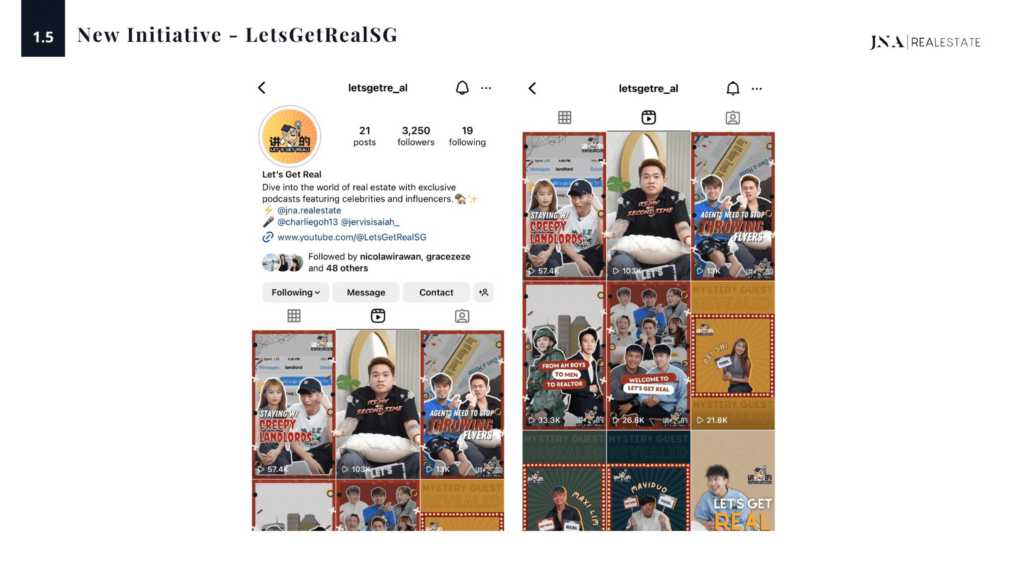

About My Team

Currently being the number 1 most subscribed & the most watched in Youtube & Social Media in PropNex Singapore. Our clients have the competitive edge when it comes to selling their homes & maximising their outreach and exposure, allowing 7 out of 10 homes to be sold at record prices.

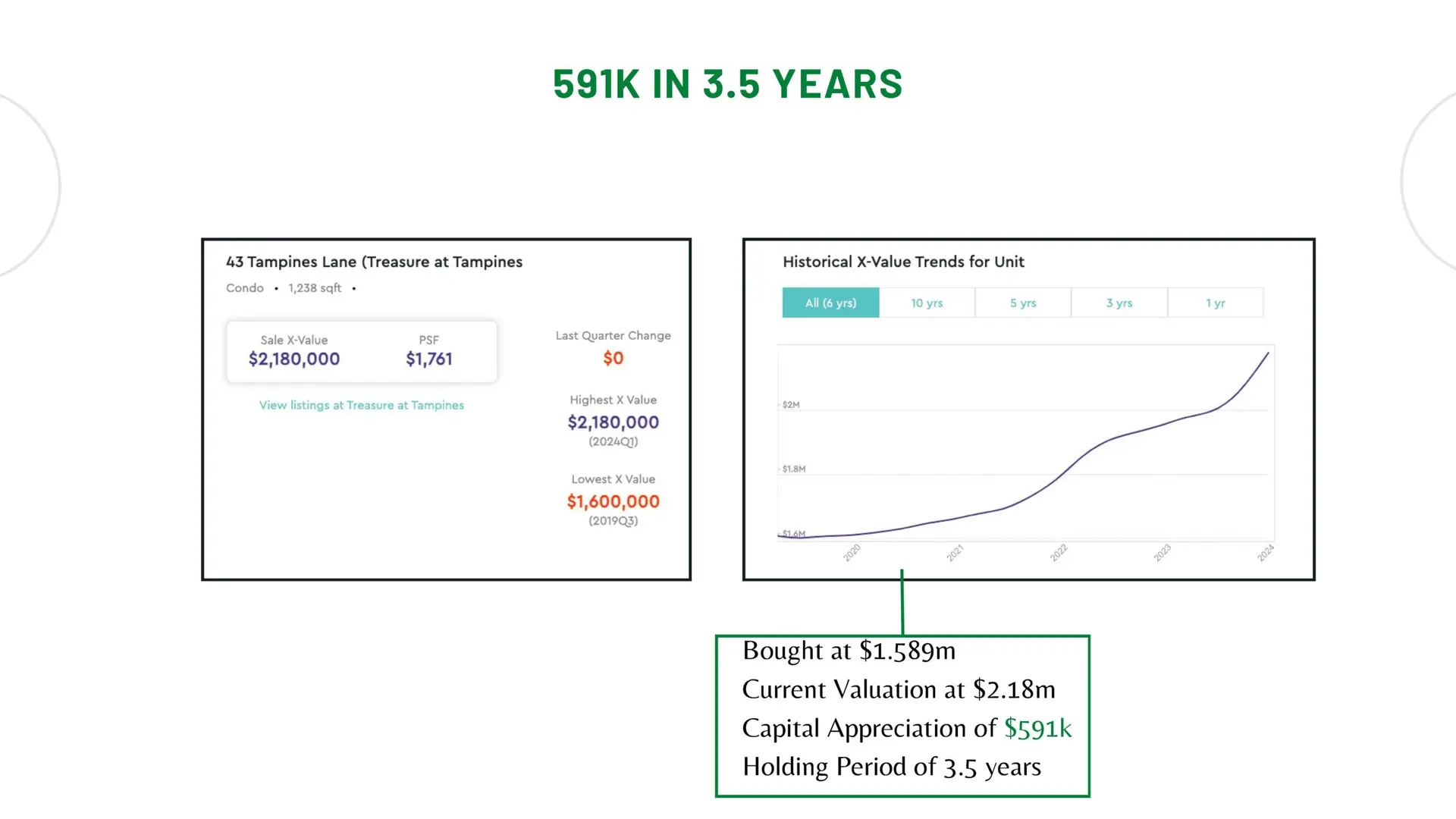

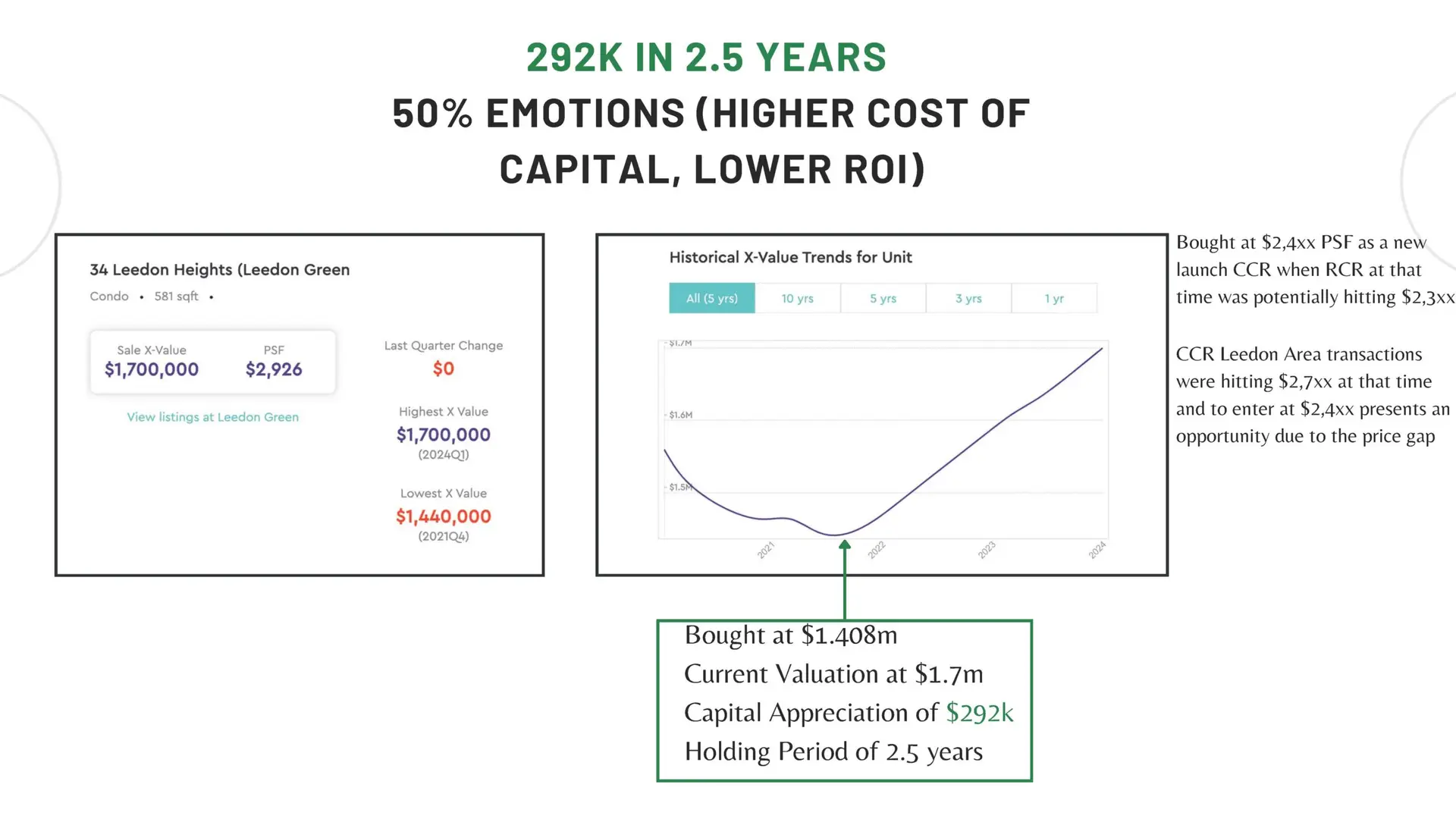

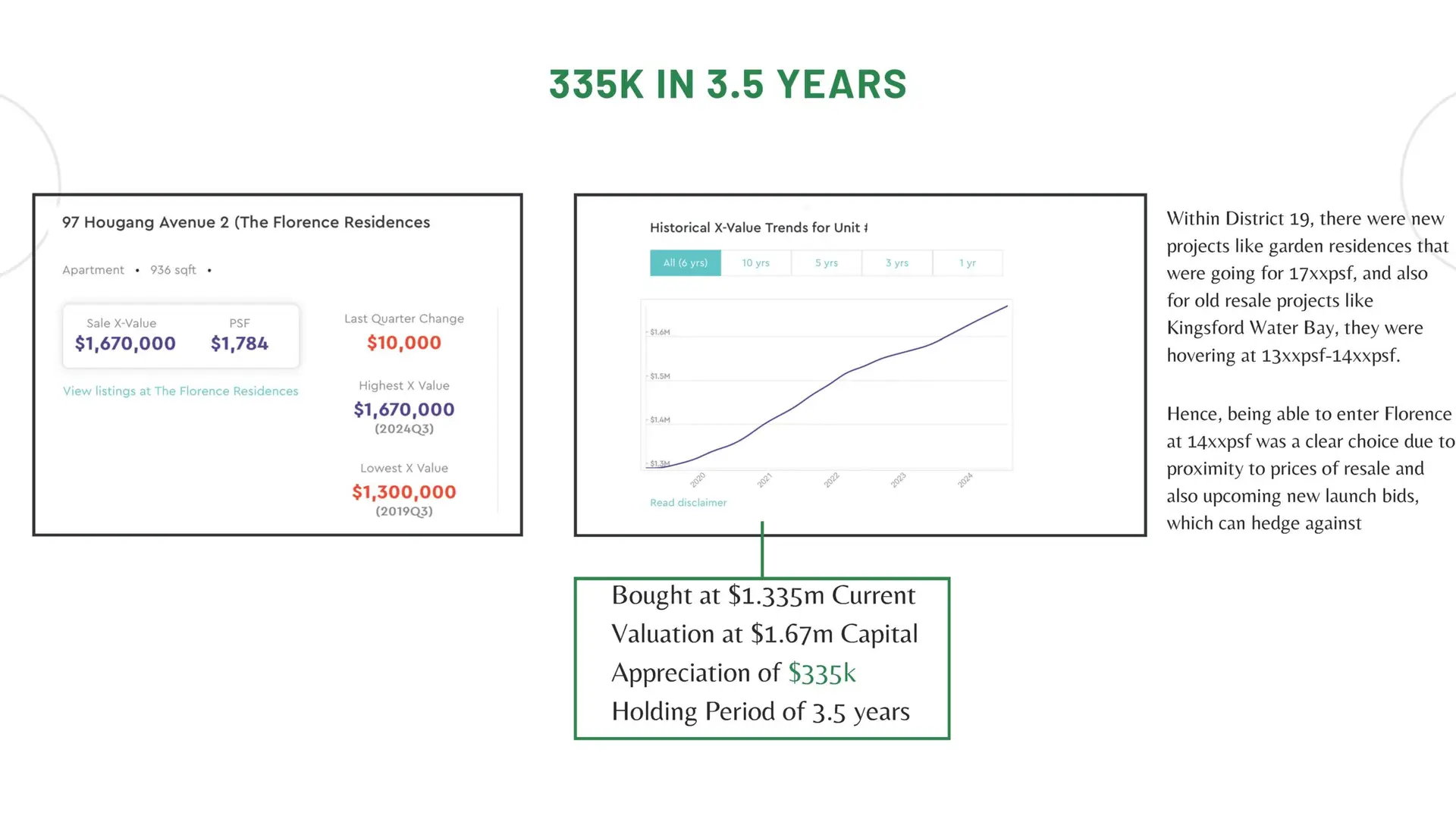

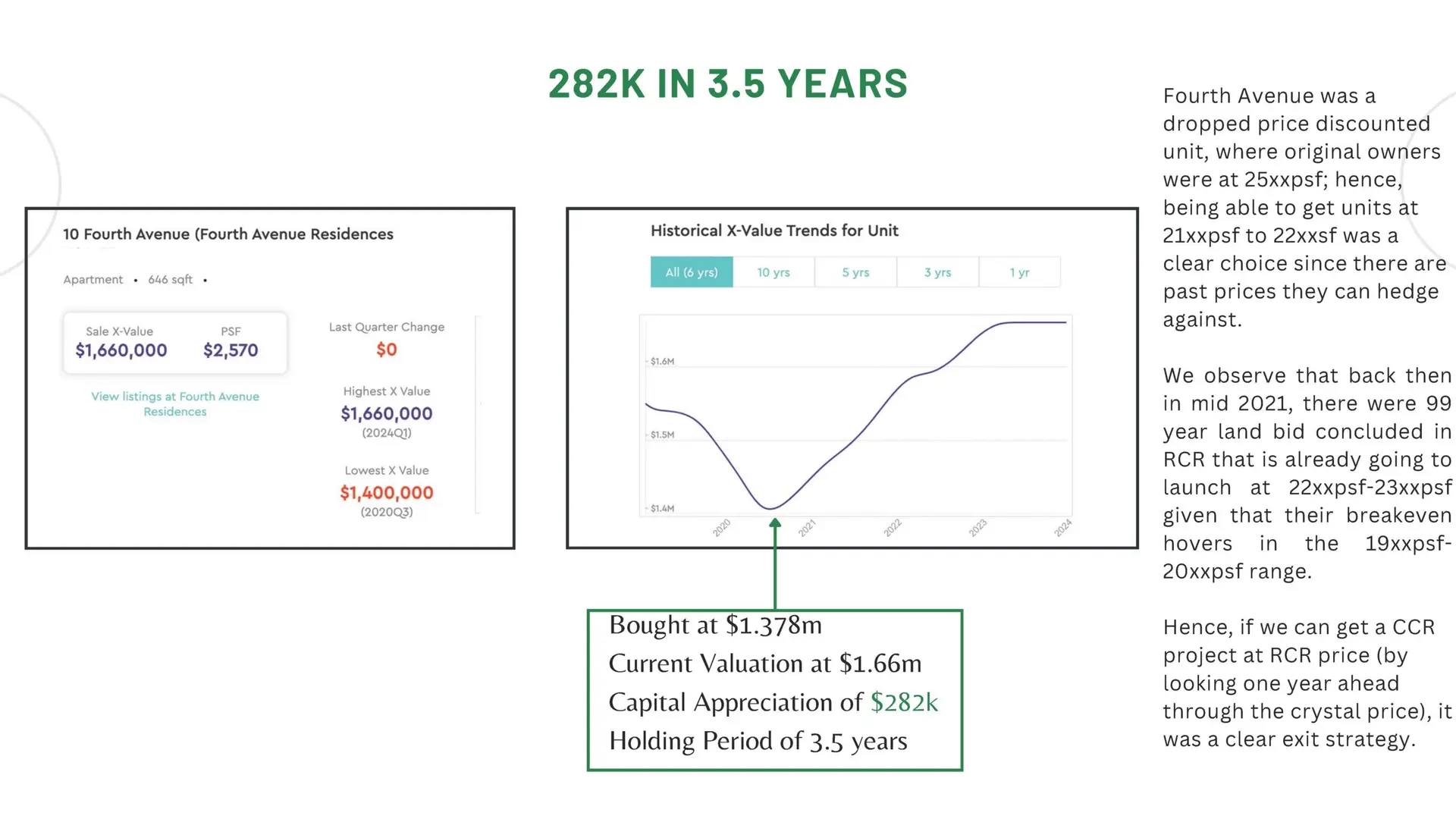

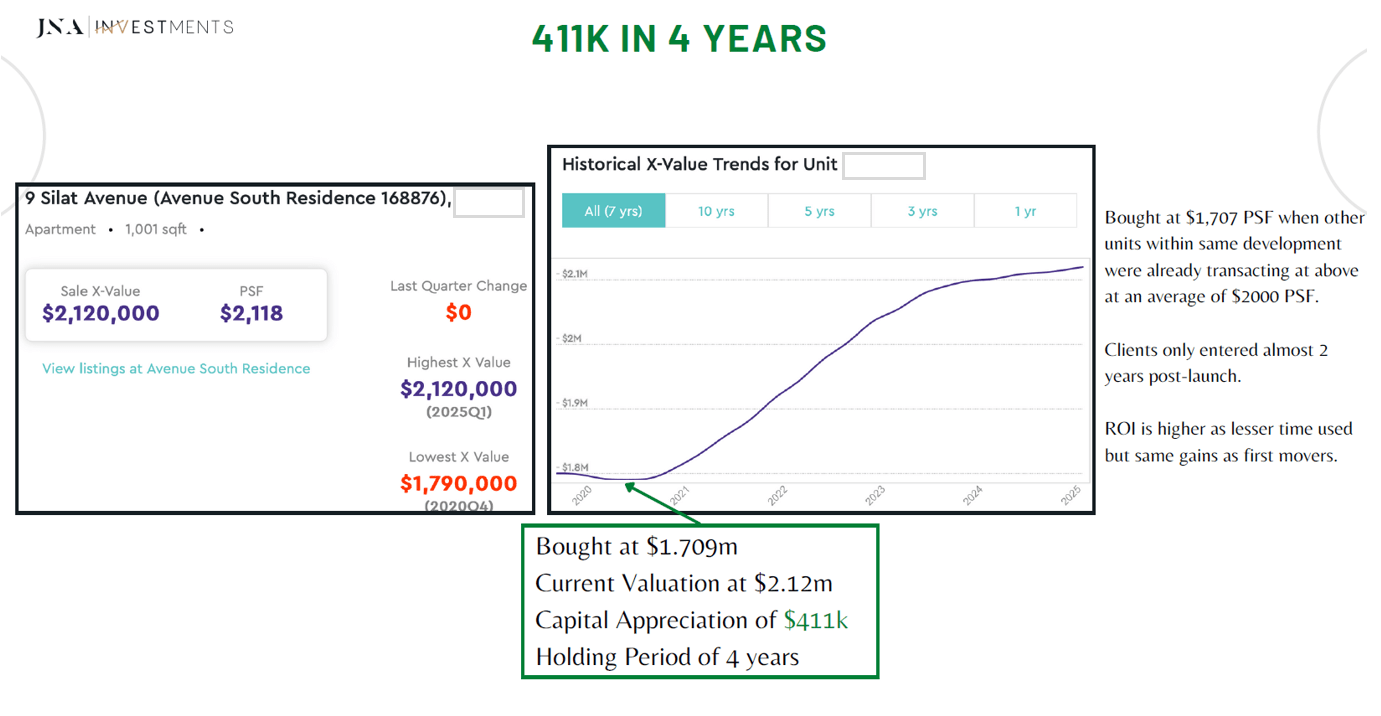

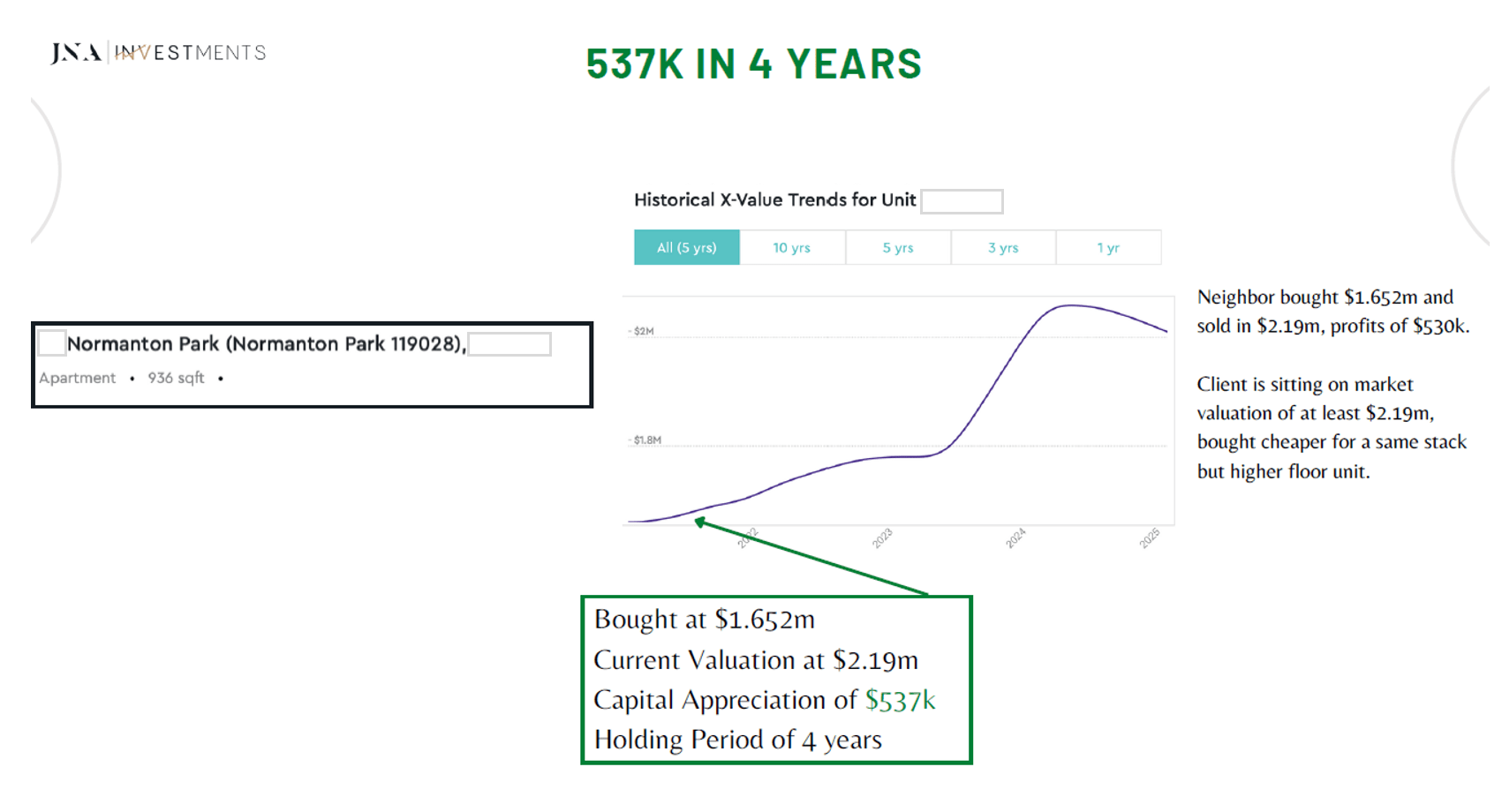

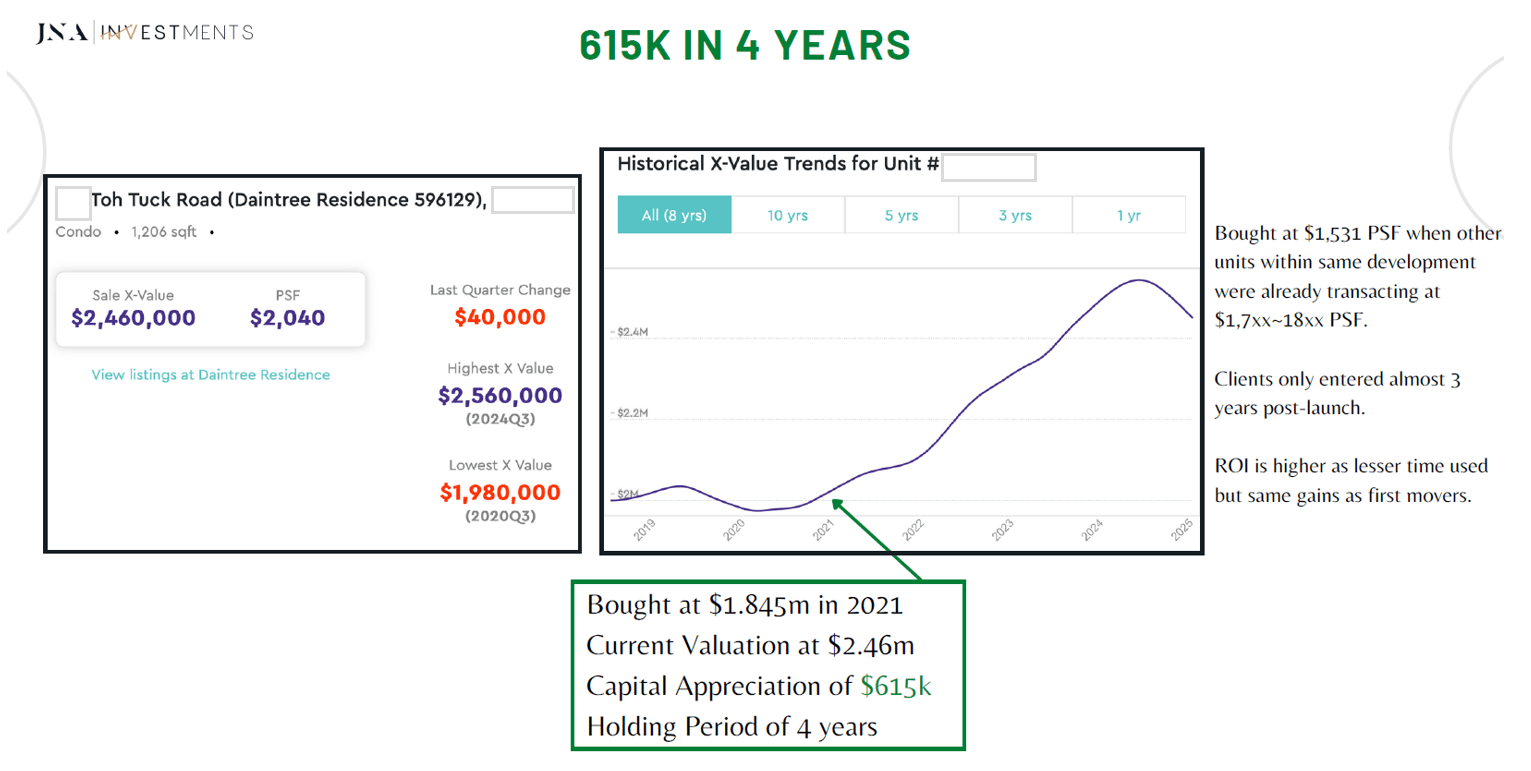

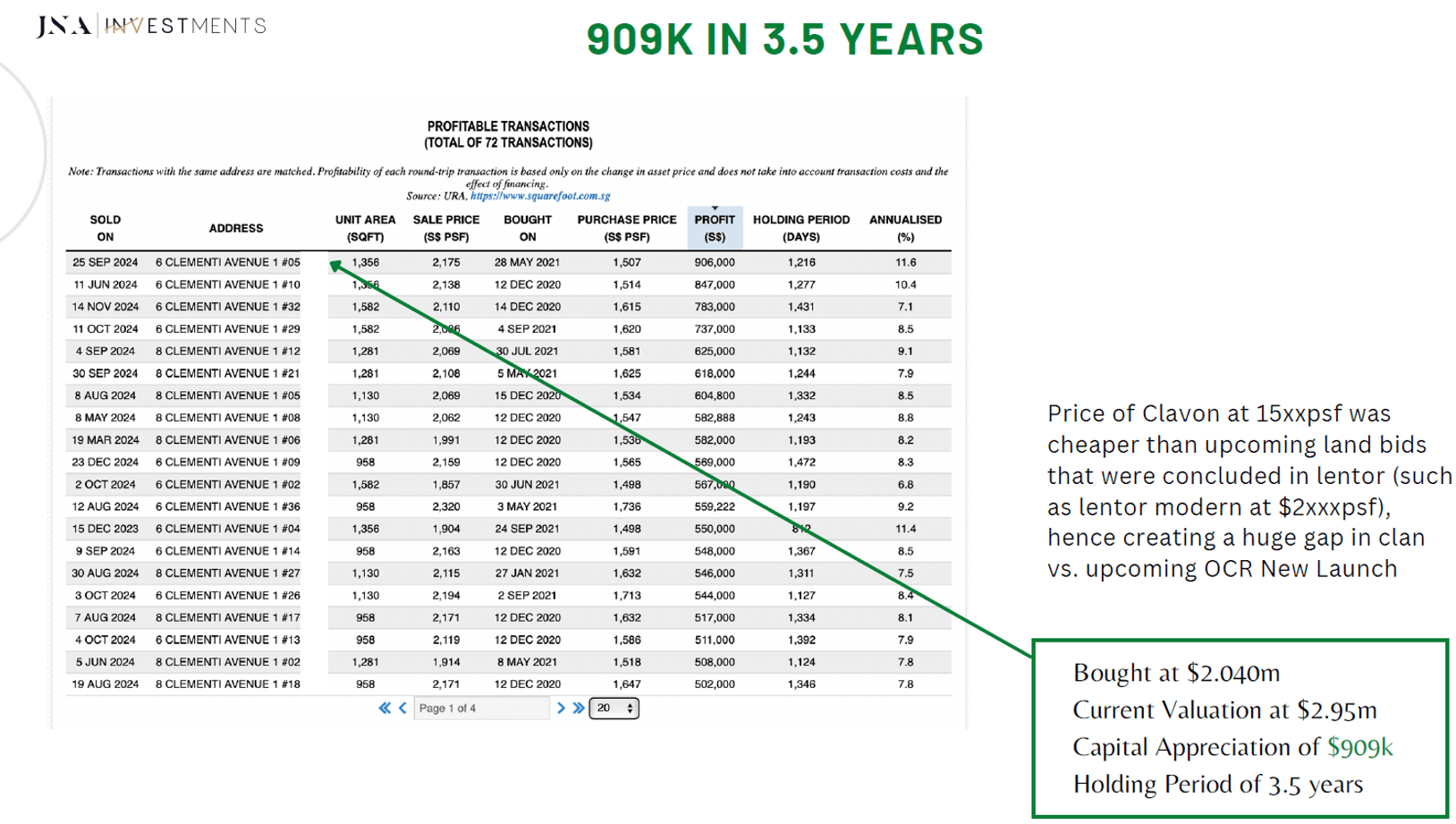

With daily in depth analysis by our brokers and full time analysts on board researching tirelessly to ensure capital gains for our clients, we have managed to attain a 19.84% return P.A doubling the performance of the average stock market returns.

Client Care Performance Record

Average of 19.84% Nett Returns Per Year for investors & Home Buyers

Average of 7/10 Homes sold at record prices

Dedicated Investment Sales Force

Damien Tan

JNA Team Leader

2 time JNA Champion Producer

5 time Champion Team in PropNex

Clifford Chin

Investment Team Lead

Gerald Lim

Residential Consultant Executive

Sharlene Soh

Sales Specialist

View Our Youtube Channel With More Than 16K Subscribers & Growing!

Who are we

JNA Real Estate, 5 Times Consecutive Champion in PropNex, the largest Real Estate Brokerage in Singapore. Being a part of this elite team of 100 brokers with a track record of 7/10 homes sold at record prices, and a return of 19.84% yearly for homebuyers, our vision is to be the 21st century real estate team that affects profitable and objective investments as well as operational excellence in selling homes

Overall Champion Producer in JNA Real Estate 2023 and 2024 consistent award recipient in JNA Real Estate, the 5 time consecutive champion team in PropNex

Schedule Your Appointment Now

This approach does not apply universally. Every individual faces distinct financial circumstances, requirements, and aspirations. To ensure its suitability for your needs, it needs to be customized to fit your specific situation.

Arrange a complimentary consultation with me today, without any commitments or sales pressure, so that I can design a personalized strategy for your Property Portfolio restructure. Leave your contact information here to get started!